Prevailing Wage and Certified Payroll are important terms in construction. Both affect how workers get paid.

Understanding these terms can help employers and workers. Prevailing Wage sets the standard pay rate for public projects. Certified Payroll ensures compliance with those wage laws. Knowing the differences can make managing projects easier. In this post, we will explore the key aspects of Prevailing Wage and Certified Payroll.

You’ll learn how they impact your business or job. Stay tuned to gain insights into these essential payroll concepts.

Credit: www.linkedin.com

Overviews of Contents

ToggleIntroduction To Prevailing Wage

Understanding prevailing wage is crucial for contractors and workers in the construction industry. It impacts wages and compliance with labor laws. This section introduces you to the concept of prevailing wage, its definition, and its importance.

Definition

Prevailing wage refers to the standard wage set by law for specific work. It applies to public works projects. These wages are often determined by government agencies. They ensure workers receive fair pay for their work.

The wage rate includes hourly pay and benefits. Benefits can include health insurance, pensions, and vacation. The goal is to provide a decent living wage for workers. This helps maintain standard wages across the industry.

Importance

Prevailing wage laws protect workers from unfair pay. They ensure that workers get paid fairly for their skills. These laws also help prevent undercutting by contractors. This creates a level playing field for all contractors.

For the community, prevailing wages ensure high-quality work. Workers paid fairly are more motivated. They are likely to perform better. This results in better project outcomes. Public works projects benefit from this quality assurance.

Prevailing wage laws also support the local economy. Higher wages mean workers have more spending power. This boosts local businesses and services. It creates a positive economic cycle in the community.

Need to understand more about Payroll? This post might help you. How Do I Contact Quickbooks Payroll Support by Phone?

Introduction To Certified Payroll

Understanding certified payroll is crucial for companies working on government projects. This term often comes up in discussions about prevailing wage laws. Let’s dive into what certified payroll means and why it matters.

Definition

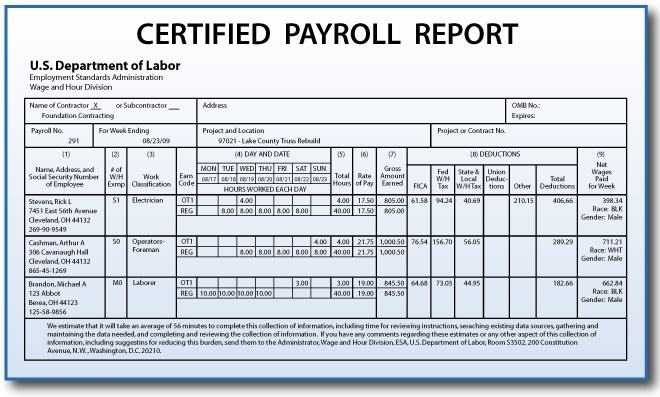

Certified payroll refers to a specialized payroll report. This report is mandatory for contractors and subcontractors working on federally funded projects. Each week, companies must submit this report to the government agency overseeing the project.

The report includes detailed information about each worker. This information covers wages, job classifications, and hours worked. All data must comply with Davis-Bacon Act requirements.

Importance

Certified payroll plays a vital role in ensuring fairness. It aims to protect workers from being underpaid. The government can monitor compliance with prevailing wage laws through these reports.

Submitting accurate certified payrolls helps avoid penalties. Non-compliance may lead to fines or even project termination. Consistent reporting builds trust between contractors and government agencies.

Additionally, certified payroll ensures transparency. It lets stakeholders verify that workers receive fair wages. This transparency fosters a positive work environment and encourages ethical business practices.

Legal Requirements

The construction industry faces many legal requirements. Two key areas are prevailing wage and certified payroll. Understanding these laws is crucial. This section covers federal and state laws on these topics.

Dive deeper into Payroll by checking out this article. How Long Does It Take to Process Payroll?

Federal Laws

Federal laws set the foundation for prevailing wage and certified payroll. The Davis-Bacon Act is a primary law. It applies to contractors working on federal projects.

The Davis-Bacon Act ensures workers get fair wages. Contractors must pay the prevailing wage. This wage is based on local standards. It includes benefits like health insurance.

Another key law is the Copeland “Anti-Kickback” Act. This law works with the Davis-Bacon Act. It stops contractors from taking back any part of the wages. This ensures workers get their full pay.

Certified payroll records are also required. Contractors must submit Form WH-347 weekly. This form details hours worked and wages paid. It ensures compliance with wage laws.

State Laws

State laws can vary but often align with federal rules. Many states have their own prevailing wage laws. These laws may cover state and local projects.

Each state sets its prevailing wage rates. These rates can differ from federal rates. Contractors must check both federal and state rates.

States also have certified payroll requirements. Some states use their own forms. Others use the federal Form WH-347. It is crucial to follow the correct process.

State laws may have stricter rules. Some states require more detailed payroll records. Others have higher penalties for non-compliance.

The table below summarizes key differences between federal and state laws:

| Aspect | Federal | State |

|---|---|---|

| Prevailing Wage Law | Davis-Bacon Act | Varies by state |

| Certified Payroll Form | Form WH-347 | Varies by state |

| Wage Rate Source | Federal standards | State standards |

| Penalties | Federal penalties | State-specific penalties |

Credit: www.epaysystems.com

Want to learn more about Payroll? This post could provide more insights. How to Automate Payroll?

Prevailing Wage Calculation

Understanding the Prevailing Wage Calculation is crucial for businesses involved in public works projects. This calculation ensures that workers are paid fairly, reflecting the local wage standards. Let’s dive into the details to see how these wages are determined.

Factors Considered

Several factors influence the prevailing wage. These include:

- Location: Wages vary by region.

- Type of Work: Different jobs have different rates.

- Experience Level: More experienced workers earn more.

- Union Agreements: Unionized jobs often pay more.

- Fringe Benefits: Benefits like health insurance are included.

Example Calculation

Here’s an example to illustrate how the prevailing wage is calculated:

| Factor | Value |

|---|---|

| Base Wage | $30 per hour |

| Fringe Benefits | $10 per hour |

| Total Prevailing Wage | $40 per hour |

In this example, the worker’s total prevailing wage is $40 per hour. This includes the base wage and fringe benefits.

Certified Payroll Reporting

Certified Payroll Reporting is a crucial aspect of adhering to federal labor laws. It ensures contractors on public works projects pay workers fair wages. Compliance can seem complex, but understanding the process simplifies it.

Required Forms

For certified payroll reporting, the most important form is the WH-347. This form captures essential information about employees’ work and wages. Every contractor must complete it accurately.

Another key form is the Statement of Compliance. This document certifies that the payroll information is correct. It also affirms that workers received the prevailing wage rates.

Want to learn more about Payroll? This post could provide more insights. What Happens If a Company Can’T Make Payroll? Consequences Unveiled

Submission Process

Submitting certified payroll reports involves several steps. First, gather all necessary documentation. This includes timesheets, wage rates, and hours worked.

Next, complete the WH-347 form and the Statement of Compliance. Ensure all information is accurate and up-to-date.

Finally, submit the forms to the appropriate federal or state agency. Some agencies allow online submission, which can save time. Always check submission deadlines to avoid penalties.

Credit: www.abcmetrowashington.org

Key Differences

Understanding the differences between prevailing wage and certified payroll is crucial. Both terms often appear in government contracts and public works projects. Knowing how they differ can help ensure compliance and avoid penalties.

Wage Determination

Prevailing wage refers to the average wage paid to workers in a specific area. The government determines this wage based on local standards. It ensures that workers receive fair pay for their labor. On the other hand, certified payroll involves documenting these wages. Contractors must submit reports showing they pay the prevailing wage rates. This documentation helps verify compliance with wage laws.

Reporting Requirements

Reporting requirements differ between prevailing wage and certified payroll. For prevailing wage, contractors must keep accurate records of hours worked and wages paid. These records help ensure that workers receive the correct wage. In contrast, certified payroll reporting involves submitting detailed payroll records. Contractors must submit these records weekly to the contracting agency. The records must include information on each worker, such as name, job classification, and wages.

Common Challenges

Understanding prevailing wage and certified payroll can be tough for many contractors. These concepts involve many rules and detailed documentation. Below, we explore the common challenges faced in managing these requirements.

Compliance Issues

Ensuring compliance with prevailing wage laws is a significant challenge. Contractors must pay workers the correct wages as per the local laws. Failure to comply can lead to penalties.

Another issue is staying updated with changing laws. Wage rates and rules can change frequently. Contractors need to stay informed to avoid compliance problems.

Misclassification of workers is a common error. It happens when workers are not classified correctly according to their job duties. This can lead to incorrect wage payments and legal issues.

Documentation

Keeping accurate records is crucial for certified payroll. Contractors must maintain detailed payroll records. These records should include information such as:

- Employee names

- Hours worked

- Wages paid

- Job classifications

Proper documentation is necessary for audits and inspections. Incomplete or incorrect records can result in fines.

Another challenge is ensuring all documentation is submitted on time. Timely submission of certified payroll reports is mandatory. Late submissions can lead to penalties.

Using technology can help manage these documentation tasks. Software tools can simplify record-keeping and ensure accuracy.

Best Practices

Understanding the best practices for managing prevailing wage and certified payroll is crucial. This ensures compliance and smooth reporting. By following these guidelines, businesses can avoid potential fines and maintain good standing with regulatory bodies.

Staying Compliant

Compliance with prevailing wage laws and certified payroll requirements is essential. Here are some key steps to stay compliant:

- Keep detailed records of hours worked and wages paid.

- Ensure all employees receive the correct prevailing wage rate.

- Regularly review and update payroll records to reflect any changes in wage rates.

- Submit certified payroll reports on time as required by the law.

By following these steps, you can ensure that your business stays compliant and avoids penalties.

Efficient Reporting

Efficient reporting is key to managing certified payroll. It saves time and reduces errors. Here are some best practices for efficient reporting:

- Use payroll software that supports certified payroll reporting.

- Automate data entry to minimize errors and save time.

- Regularly review reports for accuracy before submission.

- Train employees on the importance of accurate timekeeping and reporting.

Implementing these practices can streamline your reporting process. This ensures timely and accurate submissions.

Frequently Asked Questions

What Is Prevailing Wage?

Prevailing wage is the standard wage set by government authorities. It ensures fair compensation for laborers on public projects. These wages vary by location and job type.

What Is Certified Payroll?

Certified payroll is a report contractors submit to verify wage compliance. It includes workers’ details, hours worked, and wages paid. It ensures adherence to labor laws.

Difference Between Prevailing Wage And Certified Payroll?

Prevailing wage is the mandated wage rate for public projects. Certified payroll is the documentation proving compliance with prevailing wage laws.

Why Is Certified Payroll Important?

Certified payroll ensures contractors comply with prevailing wage laws. It protects workers from wage theft and maintains fair labor standards on public projects.

Conclusion

Understanding prevailing wage and certified payroll is crucial for contractors. These terms affect project costs and compliance. Knowing the differences helps you stay within the law. Stay informed to avoid penalties and ensure fair worker pay. Simplifying these concepts makes managing projects easier.

Keep this knowledge handy for successful construction endeavors.