Calculating a payroll budget can seem daunting. Yet, it is essential for business success.

A well-managed payroll budget helps control costs and ensures employees are paid accurately. This guide will simplify the process for you. We’ll break down each step, making it easy to follow. Proper payroll budgeting keeps your business financially healthy. It also boosts employee satisfaction by ensuring timely payments.

With clear planning, you can avoid costly mistakes. This introduction will set the stage for a deeper dive into calculating a payroll budget. Ready to learn more? Let’s get started!

Overviews of Contents

ToggleIntroduction To Payroll Budget

Understanding how to calculate a payroll budget is crucial for any business. It helps in managing finances and ensuring employees are paid on time. This guide will introduce you to the basics of a payroll budget.

Importance Of Payroll Budget

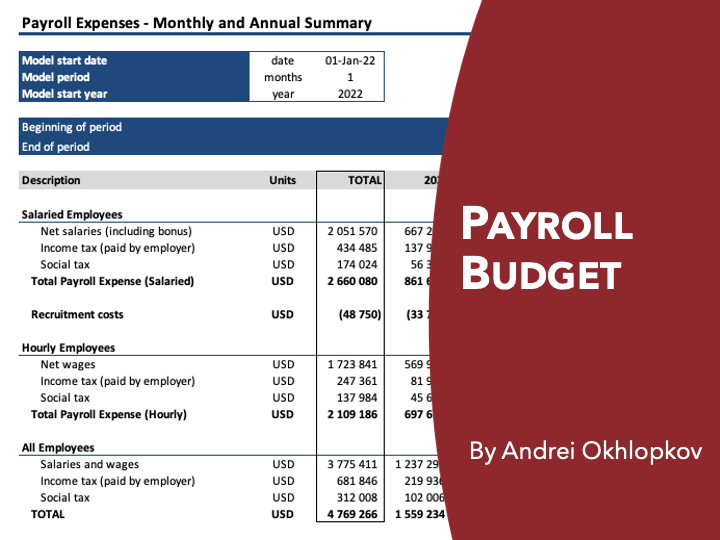

A payroll budget is important for several reasons. It helps in financial planning and ensures the business remains profitable. A well-planned payroll budget also aids in forecasting expenses. This allows for better resource allocation. It also helps in compliance with legal requirements. Accurate budgeting prevents overspending and potential financial issues.

Key Components

There are several key components in a payroll budget. The first component is employee salaries. This includes the total amount paid to all employees. Next, consider benefits and bonuses. These are additional costs on top of salaries. Taxes are another important component. This includes federal, state, and local taxes. Lastly, consider any other payroll-related expenses. This could be training costs or other employee-related expenses.

Credit: www.eloquens.com

Curious about Payroll? We've got more info in this linked article. How Do I Contact Quickbooks Payroll Support by Phone?

Gather Employee Information

Calculating a payroll budget involves several steps. One of the most crucial steps is gathering employee information. This step sets the foundation for accurate payroll management. Let’s dive into the details of what you need to gather.

Employee Details

Start by collecting basic employee details. These include names, job titles, and hire dates. Ensure you have each employee’s Social Security Number or tax identification number. This information is essential for tax purposes.

Keep records of each employee’s contact details. This includes addresses and phone numbers. Accurate contact information helps in case of any payroll discrepancies.

Work Hours

Next, track the work hours of each employee. Record both regular and overtime hours. This ensures employees are paid correctly for their time.

Maintain a detailed log of hours worked. Use time-tracking software if possible. This reduces errors and makes the payroll process smoother.

Be aware of any vacation or sick leave taken by employees. This affects their total work hours and pay.

Determine Gross Pay

Determining gross pay is a crucial step in calculating your payroll budget. Gross pay is the total amount an employee earns before any deductions. This includes taxes, benefits, and other withholdings. Let’s explore how to determine gross pay for both hourly and salaried employees.

Dive deeper into Payroll by checking out this article. How Long Does It Take to Process Payroll?

Hourly Wages

To calculate gross pay for hourly employees, multiply the hourly rate by the number of hours worked. For example, if an employee earns $15 per hour and works 40 hours a week, their gross pay is $600. It’s important to track overtime hours as well. Overtime pay is usually higher than regular pay. Check your local labor laws for specific rates.

Salaried Employees

For salaried employees, gross pay is usually simpler to calculate. Divide the annual salary by the number of pay periods in a year. For instance, an employee earning $52,000 annually paid bi-weekly will have a gross pay of $2,000 per period. Some salaried employees also receive bonuses or commissions. These should be added to their regular gross pay.

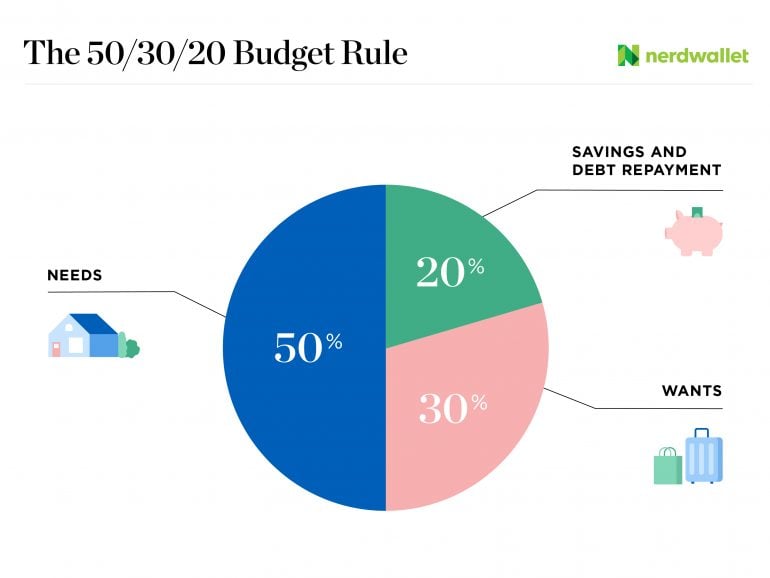

Credit: www.nerdwallet.com

Calculate Deductions

Calculating payroll deductions is crucial. It ensures employees receive accurate pay. Deductions include taxes, benefits, and other withholdings. Accurate deductions prevent errors and ensure compliance with laws. Here’s how to calculate deductions.

Taxes

Taxes are a major part of payroll deductions. Employers must withhold federal, state, and local taxes. Use the IRS tax tables for federal income tax. State and local taxes vary. Check your state’s guidelines. Social Security and Medicare taxes are also required. These are known as FICA taxes. The current rate is 7.65% of employee wages. Here’s a quick breakdown:

- Federal Income Tax: Based on IRS tax tables

- State Income Tax: Varies by state

- Local Income Tax: Varies by locality

- Social Security: 6.2% of wages

- Medicare: 1.45% of wages

Need to understand more about Payroll? This post might help you. How to Automate Payroll?

Benefits

Employee benefits can also reduce take-home pay. Common benefits include health insurance, retirement plans, and life insurance. Employers often share the cost of these benefits. Here are common benefit deductions:

| Benefit Type | Employee Contribution |

|---|---|

| Health Insurance | Varies, typically a fixed amount per paycheck |

| Retirement Plan | A percentage of salary, often 3-5% |

| Life Insurance | Small amount, often under $10 per paycheck |

Ensure to calculate these amounts accurately. This avoids discrepancies in payroll. Use payroll software to simplify calculations. It helps keep deductions precise and up-to-date.

Include Additional Costs

When calculating payroll budget, it’s crucial to include additional costs. These costs go beyond the base salary. They ensure you cover all employee-related expenses. Overlooking them can lead to budget shortfalls. Let’s discuss some of these extra costs.

Overtime Pay

Overtime pay is a common additional cost. Employees might work extra hours. This usually means paying them more than their regular rate. Ensure you know the rules in your area. Calculate how often your team works overtime. Add this to your payroll budget. This helps you avoid surprises.

Bonuses

Bonuses are another extra cost to consider. Many companies reward employees for good performance. Plan for these payments in your budget. Think about past bonuses and future expectations. This will help you set aside the right amount. It’s better to be prepared than caught off guard.

Explore more about Payroll with this related post. What Happens If a Company Can’T Make Payroll? Consequences Unveiled

Forecast Future Payroll Expenses

Forecasting future payroll expenses is crucial for effective budget management. Predicting how much you’ll spend on salaries, benefits, and taxes helps you stay financially healthy. This section will help you understand how to forecast future payroll expenses accurately.

Seasonal Variations

Many businesses experience seasonal changes. These variations affect payroll expenses significantly. For example, retail stores hire more staff during holidays. It’s vital to track these patterns. Look at your past data to identify trends. Adjust your payroll budget to match these seasonal needs. This way, you can avoid unexpected costs.

Growth Projections

Planning for growth is essential. Growth means hiring more employees. This will increase your payroll expenses. Project your business growth for the next year. Estimate the number of new hires needed. Calculate the additional salary, benefits, and taxes. Include these figures in your payroll budget. This ensures you are prepared for expansion. You can also plan for promotions and raises. This keeps your team motivated and reduces turnover.

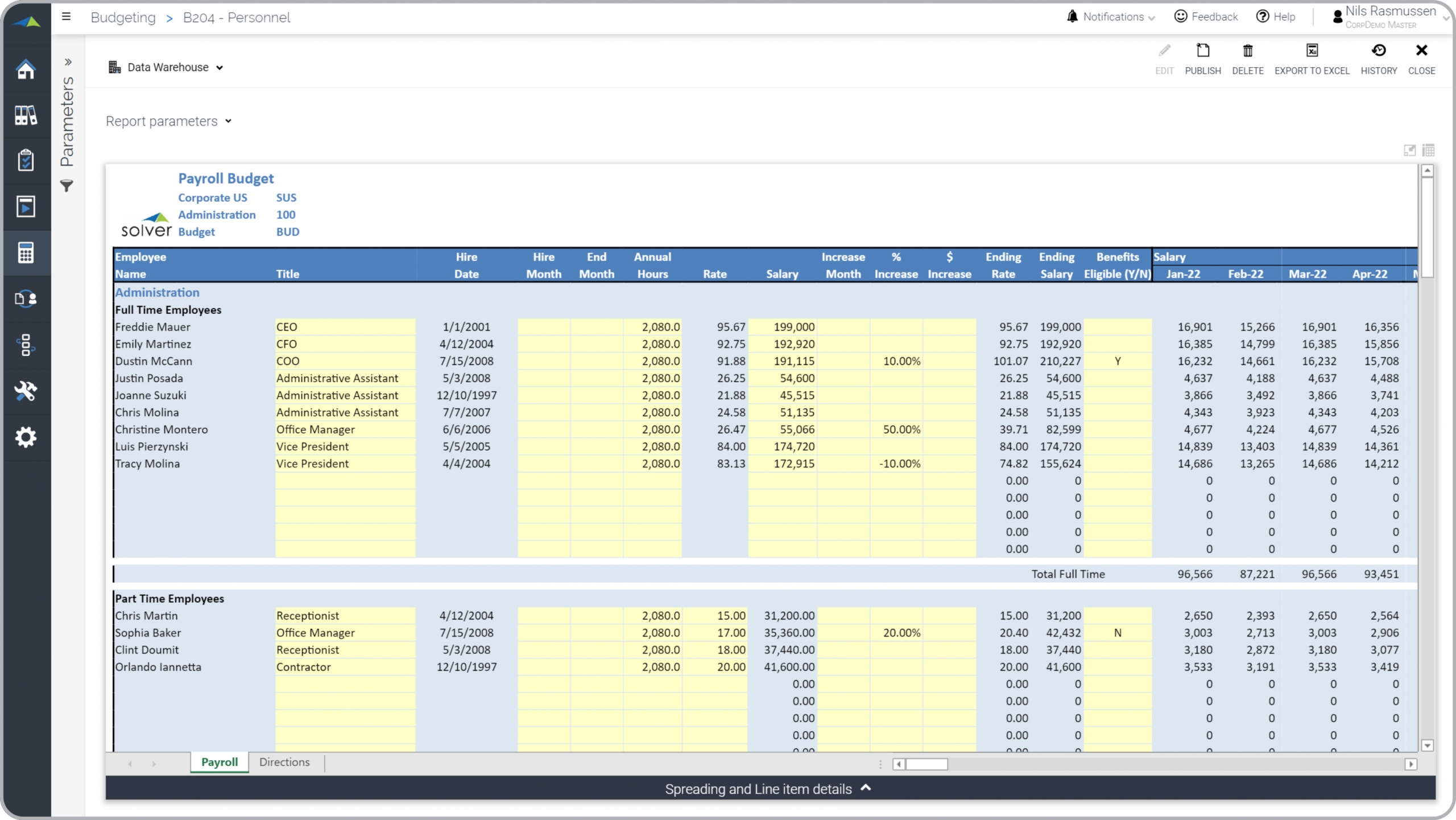

Utilize Payroll Software

Utilizing payroll software can streamline the process of calculating payroll budgets. This tool can save time and reduce errors. It ensures accuracy and compliance with tax regulations. Payroll software can handle complex calculations, making it a valuable asset for any business. Let’s explore how to choose the right software and what features to look for.

Choosing Software

Selecting the right payroll software is crucial. First, assess your business needs. Consider the size of your company. Different software suits different business sizes. Look for user reviews. They provide insight into the software’s reliability. Budget is also important. Choose software that fits your financial plan.

Software Features

Good payroll software should have key features. It must automate tax calculations. This ensures compliance with tax laws. The software should also handle direct deposits. This simplifies the payment process. Look for software that generates detailed reports. Reports help track expenses and identify issues.

Integration with other systems is a plus. It should sync with accounting and HR systems. This creates a seamless workflow. Customer support is also essential. Choose software with reliable and responsive support. This ensures help is available when needed.

Credit: www.solverglobal.com

Review And Adjust Budget

Reviewing and adjusting your payroll budget is essential for financial health. Regular reviews help you stay on track. Adjustments ensure you meet your goals. Both steps are crucial for an effective payroll budget.

Regular Reviews

Regular reviews help you spot trends and issues early. Set a schedule for these reviews. Monthly or quarterly reviews work best for most businesses. Check each expense carefully. Compare actual spending to your budget. Look for any unexpected costs.

Regular reviews also help you plan better. You can see where you may need more funds. Or where you can save money. This keeps your budget accurate and up-to-date. It also helps you make informed decisions.

Making Adjustments

Making adjustments is the next step after your reviews. If you see any discrepancies, adjust your budget. This could mean cutting costs in some areas. Or it could mean allocating more funds to others.

Adjustments keep your payroll budget realistic. They help you prepare for future changes. For example, if you plan to hire more staff, adjust your budget. Make sure you have enough funds to cover their salaries. This proactive approach avoids financial stress later.

Adjustments also help you stay compliant with tax laws. Payroll taxes can change. Regular adjustments ensure you meet all legal requirements. This protects your business from penalties.

Frequently Asked Questions

What Is A Payroll Budget?

A payroll budget is the total amount a company plans to spend on employee salaries and benefits during a specific period.

How Do I Calculate Payroll Expenses?

To calculate payroll expenses, add employee salaries, benefits, payroll taxes, and any additional compensation costs.

What Factors Affect Payroll Budget?

Factors affecting payroll budget include employee salaries, benefits, overtime, bonuses, payroll taxes, and company growth.

Why Is Payroll Budgeting Important?

Payroll budgeting is crucial to ensure financial stability, manage cash flow, and plan for future expenses accurately.

Conclusion

Calculating payroll budget doesn’t have to be hard. Follow the steps discussed. First, gather all necessary employee data. Then, understand your payroll taxes and benefits. Keep track of overtime and bonuses. Use payroll software for accuracy. Regularly review and adjust as needed.

This helps prevent overspending. Stay organized and keep records. With these tips, you can manage your payroll budget efficiently. This ensures financial stability for your business. Happy budgeting!