Automating payroll can save time and reduce errors. It streamlines the process, making paydays stress-free.

Payroll is a critical task for any business. Manual payroll management is time-consuming and prone to mistakes. Automating this process can make life easier for both employers and employees. Imagine not having to worry about calculating hours, tax deductions, or direct deposits.

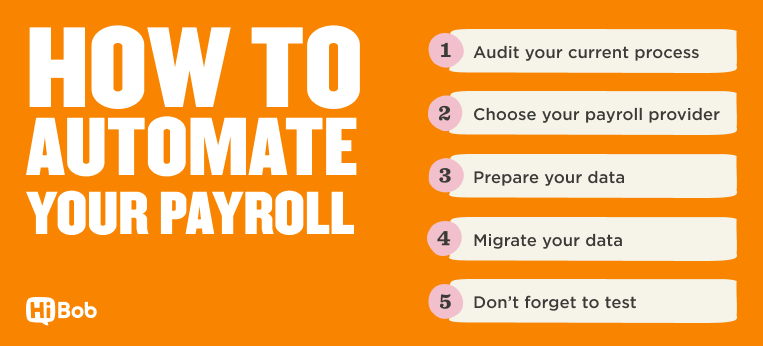

Automation ensures accuracy and compliance with tax laws. It also frees up valuable time to focus on other important aspects of your business. In this guide, we’ll explore how to automate payroll effectively. You’ll learn the benefits and steps to get started. By the end, you’ll see how simple it can be to modernize your payroll system. Ready to simplify your payroll process? Let’s dive in.

Overviews of Contents

ToggleIntroduction To Payroll Automation

Managing payroll manually can be a daunting task. Human errors, compliance issues, and time consumption are major concerns. Payroll automation simplifies these processes. It uses software to manage employee payments and taxes. It handles calculations, deductions, and timekeeping automatically.

Automating payroll ensures accuracy and saves time. It helps businesses focus on growth. This blog explores the benefits and challenges of payroll automation.

Benefits Of Automation

Automating payroll has multiple benefits. Here are some key advantages:

- Time-saving: Automation reduces the time spent on manual calculations.

- Accuracy: It minimizes human errors, ensuring accurate payments.

- Compliance: It helps in adhering to tax laws and regulations.

- Cost-effective: Reduces the need for extensive payroll staff.

- Data Security: Ensures sensitive data is securely stored and accessed.

Expand your knowledge about Payroll with this article. How Do I Contact Quickbooks Payroll Support by Phone?

Common Payroll Challenges

Even with automation, businesses face some challenges. Below are common payroll issues:

- Integration: Integrating payroll software with existing systems can be complex.

- Data Accuracy: Ensuring the input data is accurate is crucial.

- Compliance: Keeping up with changing regulations requires constant updates.

- Employee Training: Staff must be trained to use new software effectively.

- Initial Costs: Implementing payroll automation requires an initial investment.

Addressing these challenges ensures a smooth transition to payroll automation. Investing in quality software and training can mitigate most issues.

Credit: quickbooks.intuit.com

Choosing Payroll Software

Automating payroll can save time and reduce errors. The first step is choosing the right payroll software. The right software will streamline your payroll process, ensuring your employees are paid accurately and on time. Here are some key features to look for and top software options to consider.

Key Features To Look For

- User-Friendly Interface: Easy navigation and intuitive design are crucial. This ensures that even non-tech-savvy users can handle payroll tasks efficiently.

- Compliance Management: The software should help you stay compliant with tax laws and regulations. This feature ensures you avoid legal penalties.

- Integration Capabilities: The ability to integrate with your accounting software, HR tools, and time-tracking systems is vital. It streamlines data flow and reduces manual data entry.

- Automated Calculations: Look for software that automatically calculates deductions, taxes, and other withholdings. This reduces the risk of errors.

- Direct Deposit: Ensure the software supports direct deposit. This feature speeds up the payment process and is preferred by most employees.

- Reporting and Analytics: The ability to generate detailed reports on payroll expenses, employee earnings, and tax liabilities is beneficial. It helps in financial planning and audits.

Need to understand more about Payroll? This post might help you. How Long Does It Take to Process Payroll?

Top Software Options

| Software | Key Features |

|---|---|

| Gusto |

|

| ADP |

|

| Paychex |

|

Choosing the right payroll software involves evaluating the features that best meet your business needs. By focusing on user-friendliness, compliance, integration capabilities, and automated calculations, you can find the perfect solution for your payroll automation.

Setting Up Payroll Software

Setting up payroll software can seem like a big task. But it doesn’t have to be. With the right steps, it can be simple. This section will guide you through the setup process. You will learn about the installation process and initial configuration.

Installation Process

First, download the payroll software from the provider’s website. Ensure you choose the correct version for your operating system. Once downloaded, open the installer file. Follow the on-screen instructions. Accept the terms and conditions. Select the installation location. Click “Install” to begin the process.

The installation process may take a few minutes. Do not turn off your computer during this time. Once the installation is complete, you will see a confirmation message. Click “Finish” to close the installer. The software is now installed on your computer.

Initial Configuration

Open the payroll software to start the initial configuration. You will need to enter your company details. This includes the company name, address, and tax identification number. Make sure all information is accurate.

Next, set up your payroll schedule. Choose how often you will pay your employees. This could be weekly, bi-weekly, or monthly. Enter the start date for the first payroll period.

You will also need to add employee information. This includes names, addresses, and social security numbers. Enter the payment details for each employee. This could be hourly wages or annual salaries. Double-check all information for accuracy.

Configure tax settings based on your location. The software will use this information to calculate taxes. Make sure to enter the correct tax rates. Finally, set up direct deposit details if you will use this payment method. Your payroll software is now ready for use.

Credit: www.360connect.com

Looking for more insights on Payroll? You may find this post valuable. What Happens If a Company Can’T Make Payroll? Consequences Unveiled

Integrating With Existing Systems

Integrating payroll automation with existing systems can save time and reduce errors. Seamless integration ensures that all your data is consistent and up-to-date. This section will focus on how to sync payroll systems with accounting software and HR systems.

Syncing With Accounting Software

Syncing your payroll system with accounting software is crucial. This integration ensures all financial data is aligned. Automated syncing reduces manual data entry. It also minimizes the risk of errors. Ensure your payroll software is compatible with your accounting system. Popular options like QuickBooks and Xero often offer easy integration.

Some payroll systems come with built-in features for syncing. Check if your current system supports this. If not, look for third-party tools. These can bridge the gap between your payroll and accounting software. Regularly update both systems to maintain compatibility. This ensures smooth and continuous data flow.

Hr System Integration

HR system integration is another key factor. Your payroll and HR systems should work together seamlessly. This integration streamlines employee data management. Changes made in the HR system reflect automatically in the payroll system. This reduces the need for double entry.

Ensure your HR software supports integration with your payroll system. Many modern HR systems offer this feature. If your current HR system lacks this, consider upgrading. An integrated system improves efficiency. It also enhances data accuracy. Look for systems that offer easy setup and robust support.

In summary, integrating payroll systems with accounting and HR software is vital. This integration ensures accurate, timely, and consistent data across all platforms. By doing so, you can save time, reduce errors, and focus on more strategic tasks.

Expand your knowledge about Payroll with this article. Gross Payroll How to Record It?

Data Security And Compliance

Ensuring data security and compliance is crucial when automating payroll. Companies must safeguard sensitive employee information and adhere to legal requirements. In this section, we will explore two key areas: Ensuring Data Privacy and Meeting Regulatory Requirements.

Ensuring Data Privacy

Protecting employee data should be your top priority. Automated payroll systems handle sensitive information like Social Security numbers and bank details. Here are some steps to enhance data privacy:

- Encryption: Encrypt all data, both in transit and at rest.

- Access Control: Limit access to sensitive data to authorized personnel only.

- Regular Audits: Conduct regular security audits to identify vulnerabilities.

- Employee Training: Train employees on data privacy best practices.

These measures help ensure your payroll data remains secure.

Meeting Regulatory Requirements

Automating payroll requires compliance with various laws and regulations. Failure to comply can lead to penalties. Here are some key regulatory areas to focus on:

- GDPR Compliance: If operating in the EU, ensure your payroll system complies with GDPR.

- HIPAA Compliance: For healthcare organizations, ensure HIPAA regulations are followed.

- Local Labor Laws: Adhere to local labor laws regarding payroll processing and employee rights.

- Tax Regulations: Ensure accurate tax calculations and timely filings with relevant authorities.

Compliance with these regulations ensures smooth and lawful payroll operations.

In summary, data security and compliance are vital for payroll automation. Follow best practices for data privacy and stay updated on regulatory requirements.

Automating Payroll Calculations

Automating payroll calculations can save businesses time and reduce errors. It ensures employees are paid accurately and on time. Let’s explore how to handle taxes, manage benefits, and deductions effectively using automation.

Handling Taxes

Taxes are a crucial part of payroll. Automating tax calculations can reduce mistakes. Payroll software can calculate federal and state taxes. It can also update tax rates automatically. This ensures compliance with tax laws. Automation helps avoid penalties from incorrect tax filings.

Managing Benefits And Deductions

Benefits and deductions can be complex. Automating these calculations simplifies the process. Payroll software can handle health insurance, retirement plans, and other benefits. It can also manage various deductions. This includes things like garnishments and loan repayments. Automation ensures accurate benefit and deduction calculations. This helps maintain employee satisfaction and company compliance.

Generating Reports

Generating reports is a crucial part of automating payroll. Reports provide a clear overview of payroll activities. They ensure accuracy and compliance with legal requirements. Automated systems can generate various reports, making the payroll process efficient.

Monthly Payroll Reports

Monthly payroll reports are essential for tracking employee payments. These reports show details like salaries, bonuses, and deductions. Automated systems can generate these reports quickly. This saves time and reduces errors. Employers can review monthly expenses and make informed decisions. Consistent reporting ensures transparency and accountability.

Year-end Tax Documents

Year-end tax documents are vital for tax filing. These documents include important information like total earnings and taxes withheld. Automated payroll systems can generate these documents accurately. This helps employees and employers during tax season. It ensures compliance with tax laws and avoids penalties. Automation makes the process smoother and stress-free.

Credit: www.hibob.com

Troubleshooting And Support

Automating payroll can save time and reduce errors. But sometimes, issues arise. This section provides tips on troubleshooting and support. It covers common problems and how to get help.

Common Issues And Fixes

Even the best systems face hiccups. Here are some common issues and their fixes:

- Incorrect Employee Data: Ensure all employee information is accurate.

- Software Glitches: Restart the software. Update to the latest version.

- Payment Delays: Check bank details. Confirm payroll processing dates.

- Tax Calculation Errors: Verify tax settings. Consult a tax professional.

Getting Help From Support

If problems persist, contacting support is essential. Most payroll software offers robust support options.

| Support Option | Details |

|---|---|

| Phone Support | Immediate assistance. Speak directly with a representative. |

| Email Support | Send detailed queries. Get written responses. |

| Live Chat | Quick responses. Chat in real-time with support staff. |

| Help Center | Access articles and guides. Find solutions independently. |

Use these support options for efficient problem-solving. Keeping your payroll system running smoothly ensures your business operates effectively.

Future Trends In Payroll Automation

Payroll automation is evolving rapidly. New technologies are shaping its future. Businesses are keen to adopt these advancements for efficiency. Two key trends stand out: AI and Machine Learning, and Blockchain Technology.

Ai And Machine Learning

AI and Machine Learning are transforming payroll systems. They can handle complex calculations easily. Errors become less frequent. These technologies learn from data patterns. They can predict future payroll needs. This helps in better planning. AI chatbots can answer employee queries instantly. This saves time for HR teams. Payroll processing becomes faster and more accurate.

Blockchain Technology

Blockchain offers secure and transparent payroll transactions. It ensures data integrity. Each transaction gets recorded in a secure ledger. This reduces fraud risks. Cross-border payments become simpler with blockchain. It minimizes transaction fees. Employees receive their salaries faster. Blockchain also ensures compliance with regulations. This makes audits easier and more reliable.

Frequently Asked Questions

What Is Payroll Automation?

Payroll automation is the use of software to streamline payroll processing. It helps reduce manual errors, saves time, and ensures compliance with regulations.

How Does Payroll Automation Work?

Payroll automation works by integrating employee data into payroll software. It automatically calculates wages, taxes, and deductions, then processes payments efficiently.

Why Is Payroll Automation Important?

Payroll automation is important because it improves accuracy, saves time, and reduces administrative workload. It also ensures compliance with tax laws and regulations.

Can Small Businesses Benefit From Payroll Automation?

Yes, small businesses can benefit from payroll automation. It simplifies payroll processing, reduces errors, and saves valuable time, allowing focus on core business activities.

Conclusion

Automating payroll can save time and reduce errors. It streamlines processes and ensures compliance. Employees receive accurate payments promptly. Businesses can focus on growth, not paperwork. Embracing technology in payroll management brings efficiency. It’s a smart choice for any business.

Start automating your payroll today. Enjoy the benefits of a smoother payroll system.