Processing payroll is crucial for any business. It ensures employees get paid on time.

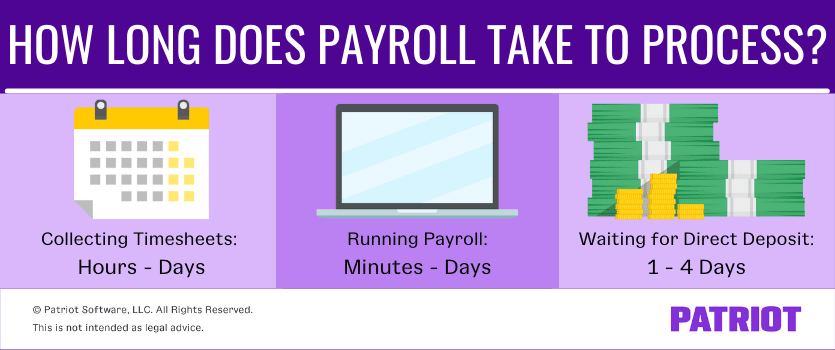

But, how long does it really take to process payroll? Payroll processing time varies by company size and complexity. Some businesses can do it in a few hours, while others may need several days. Accurate and timely payroll is essential to keep employees happy and the business compliant.

Understanding the factors that influence payroll processing time can help streamline the process and reduce delays. In this blog, we will explore the typical timeframes for payroll processing and what affects them. We will also provide tips to make your payroll process more efficient. Stay tuned to learn everything you need to know about payroll processing time.

Overviews of Contents

ToggleFactors Affecting Payroll Time

Processing payroll can be a complex task. Several factors affect how long it takes to process payroll. Understanding these factors helps streamline the payroll process. Let’s explore some key elements that can impact payroll time.

Company Size

The size of the company plays a major role in payroll processing time. A small company with fewer employees can process payroll faster. Larger companies with more employees face more challenges.

- Small companies: Quick and simple payroll processing

- Medium companies: Moderate time for payroll tasks

- Large companies: Extensive time due to employee numbers

Explore more about Payroll with this related post. How Do I Contact Quickbooks Payroll Support by Phone?

Number Of Employees

The number of employees directly affects payroll time. More employees mean more data to process. Each employee’s information must be accurate and up-to-date.

Here is a breakdown:

| Number of Employees | Payroll Time |

|---|---|

| 1-50 | Short |

| 51-200 | Moderate |

| 201-500 | Long |

| 500+ | Very Long |

Payroll Frequency

Payroll frequency also impacts processing time. Companies may pay employees weekly, bi-weekly, semi-monthly, or monthly. Each frequency has its own challenges and benefits.

- Weekly: Fast and frequent processing

- Bi-weekly: Balanced time and effort

- Semi-monthly: Less frequent, more data at once

- Monthly: Least frequent, most data to handle

Each of these factors plays a crucial role in payroll processing time. Understanding them helps optimize the payroll process and reduce delays.

Payroll Processing Steps

Processing payroll can seem complex, but breaking it down into steps makes it easier to manage. Each step is crucial for accurate and timely payments. Let’s look at the main steps involved in payroll processing.

Data Collection

The first step is data collection. Gather all necessary employee information. This includes hours worked, overtime, and any leave taken. Accurate data is key to ensure correct payments.

Calculation Of Wages

Next, calculate the wages. Use the collected data to compute total earnings. Include regular hours, overtime, and bonuses. Ensure all calculations are accurate to avoid errors.

Deductions And Taxes

The final step involves deductions and taxes. Deduct necessary amounts for taxes, social security, and other contributions. Ensure compliance with local laws and regulations. This step ensures employees receive the correct net pay.

Want to learn more about Payroll? This post could provide more insights. How to Automate Payroll?

Manual Vs. Automated Payroll

Processing payroll is a critical task for any business. It ensures employees are paid accurately and on time. There are two main methods: manual and automated payroll. Each has its own set of benefits and drawbacks. Understanding these can help you decide which is best for your business.

Benefits Of Manual Payroll

Manual payroll involves calculating and distributing paychecks by hand. This method gives business owners full control over the payroll process. You can easily spot and correct errors. It is also cost-effective for small businesses with few employees.

However, manual payroll can be time-consuming. It requires a significant amount of attention to detail. Here are some of the main benefits:

- Direct control over calculations and distributions

- Minimal upfront costs

- Flexibility in handling unique payroll scenarios

Advantages Of Automated Systems

Automated payroll systems use software to manage the payroll process. These systems can handle multiple tasks with high accuracy. They save time and reduce the risk of human error. Automated systems can also easily scale with your business growth.

Here are some key advantages:

- Time-saving and efficient processes

- Reduced risk of errors

- Ability to handle complex calculations

- Integration with other systems like accounting software

Many automated payroll systems come with features like direct deposit and tax filing. This further simplifies the payroll process and ensures compliance with regulations.

Choosing between manual and automated payroll depends on your business needs. Both methods have their own advantages. Understanding these can help you make an informed decision.

Find out more about Payroll by exploring this related topic. What Happens If a Company Can’T Make Payroll? Consequences Unveiled

Average Time For Payroll Processing

The average time for payroll processing varies depending on the size and structure of a business. Small businesses, medium enterprises, and large corporations each have different needs and resources. Understanding these differences helps streamline the process and ensures timely employee payments.

Small Businesses

Small businesses often have fewer employees and simpler payroll structures. On average, they spend about 2-5 hours per pay period on payroll processing.

This includes tasks such as:

- Calculating hours worked

- Applying tax withholdings

- Issuing checks or direct deposits

Using payroll software can reduce this time significantly. Automation handles repetitive tasks and reduces errors.

Medium To Large Enterprises

Medium to large enterprises have more complex payroll needs. These companies often have multiple departments and pay scales. On average, they spend about 8-12 hours per pay period on payroll processing.

Common tasks include:

- Managing employee benefits

- Handling multiple tax jurisdictions

- Processing overtime and bonuses

These businesses often use advanced payroll systems. These systems integrate with other HR functions to streamline the process. This integration helps manage the increased complexity efficiently.

Tips To Speed Up Payroll Processing

Payroll processing can be time-consuming. Businesses often seek ways to speed it up. Here are some tips to speed up payroll processing. These methods will save time and reduce errors.

Streamlining Data Collection

Collecting data accurately and quickly is crucial. Use standardized forms for all employees. This ensures consistency. Ensure all information is complete and up-to-date.

Regularly review and update employee records. Mistakes or outdated info cause delays. Encourage employees to update their details as needed.

Consider using a digital system to collect and store data. This reduces paperwork and speeds up retrieval. Digital records are easier to update and maintain.

Want to learn more about Payroll? This post could provide more insights. Gross Payroll How to Record It?

Using Payroll Software

Payroll software automates many tasks. It calculates wages, taxes, and deductions. This reduces human error and saves time.

Choose software that integrates with your accounting system. This streamlines the entire process. Look for software with user-friendly interfaces. This ensures ease of use and quick adoption by staff.

Many payroll software solutions offer additional features. These include direct deposit and automated tax filing. These features further speed up the process.

Outsourcing Payroll Tasks

Outsourcing payroll can be a smart move. It frees up time for other important tasks. Professional payroll services handle all aspects of payroll processing.

They ensure compliance with regulations and reduce errors. This can save your business from costly mistakes. Choose a reputable service provider with experience in your industry.

Outsourcing can also provide access to additional services. These may include HR support and employee benefits management. This can further streamline your business operations.

| Method | Benefit |

|---|---|

| Streamlining Data Collection | Reduces errors and speeds up data retrieval |

| Using Payroll Software | Automates tasks and integrates with accounting systems |

| Outsourcing Payroll Tasks | Frees up time and ensures compliance |

Credit: technologyadvice.com

Common Payroll Processing Errors

Payroll processing is a vital task for any business. Ensuring all employees are paid correctly and on time is crucial. Unfortunately, payroll processing errors can occur and cause significant issues. Understanding these errors can help you avoid them and ensure your payroll process runs smoothly.

Incorrect Employee Data

Errors in employee data can lead to payroll issues. It’s essential to have accurate information for each employee. Common errors include:

- Wrong social security numbers

- Incorrect addresses

- Wrong bank account details

These errors can result in missed payments or tax issues. Always double-check employee data for accuracy.

Miscalculations

Miscalculations are another frequent problem in payroll processing. These can occur in various ways, such as:

- Incorrect hourly rates

- Errors in overtime calculations

- Missteps in tax withholdings

Using reliable payroll software can reduce miscalculations. Regular audits can also help catch mistakes early.

Late Payments

Late payments can damage employee trust and morale. Common causes of late payments include:

- Missed deadlines

- System errors

- Manual processing delays

To avoid late payments, set reminders for payroll deadlines. Automate as much of the process as possible to ensure timely payments.

Choosing The Right Payroll Solution

Choosing the right payroll solution is crucial for any business. It can save time, reduce errors, and ensure compliance with legal requirements. The right solution depends on the size of your company, your budget, and your specific needs. Below, we explore three key areas to consider when deciding on a payroll solution.

Evaluating Software Options

Start by looking at different payroll software options. There are many available, ranging from basic to advanced features. Consider the user interface and ease of use. A good payroll software should be intuitive and easy to navigate. Check if the software integrates with your existing systems. This can save a lot of time and hassle.

Look for features like direct deposit, tax filing, and employee self-service portals. These can greatly streamline payroll processing. Don’t forget to read reviews from other users. Their experiences can provide valuable insights.

Considering Outsourcing

Outsourcing payroll is another option. This can be beneficial for small businesses with limited resources. By outsourcing, you can focus on core business activities. Payroll providers handle all aspects of payroll processing. This includes calculating wages, withholding taxes, and filing tax returns.

Outsourcing can reduce the risk of errors and ensure compliance. It can also save time and provide peace of mind. When choosing a provider, check their reputation and experience. Make sure they offer reliable customer support.

Ensuring Compliance

Compliance is a critical factor in payroll processing. Non-compliance can lead to fines and legal issues. Ensure the payroll solution you choose complies with local, state, and federal laws. This includes tax regulations, labor laws, and reporting requirements.

Many payroll software and outsourcing providers offer compliance features. These can help you stay up-to-date with changing laws. Regular audits and updates are essential to maintain compliance. Choose a solution that offers these services.

Credit: www.patriotsoftware.com

Frequently Asked Questions

What Is Payroll Processing?

Payroll processing is the task of managing employee payments. It involves calculating wages, taxes, and deductions. It’s crucial for ensuring timely and accurate paychecks.

How Long Does Payroll Processing Take?

Payroll processing time varies. It typically takes 1 to 2 days. Larger companies may take longer due to more employees and complex calculations.

What Factors Affect Payroll Processing Time?

Several factors affect payroll processing time. These include the number of employees, complexity of pay structures, and accuracy of data. Efficient software can speed up the process.

Can Payroll Be Processed Manually?

Yes, payroll can be processed manually. However, it is time-consuming and prone to errors. Automated systems are recommended for accuracy and efficiency.

Conclusion

Processing payroll takes time and attention to detail. Each step is crucial. From data collection to final approval, every process matters. Small businesses might take a few hours. Larger companies could need several days. Tools and software can help speed things up.

Accurate payroll processing ensures happy employees. Plan ahead and stay organized. This way, payroll can run smoothly and on time. Remember, consistency is key for efficient payroll management.