Gross payroll refers to the total amount paid to employees before any deductions. Recording gross payroll accurately is crucial for businesses.

It ensures compliance with tax laws and proper financial reporting. Managing payroll can be challenging, especially for small businesses.

Understanding how to record gross payroll correctly is essential. It involves tracking employee earnings, taxes, and benefits. This process helps in maintaining clear financial records.

In this blog post, we’ll explore the steps to record gross payroll. By the end, you’ll have a solid grasp of the process. You’ll be able to ensure accuracy and compliance in your business’s payroll records.

Let’s dive into the details and simplify the complexities of payroll management.

Overviews of Contents

ToggleWhat Is Gross Payroll?

Gross payroll refers to the total amount of money a company pays its employees before any deductions. This includes wages, overtime, bonuses, and commissions. It does not include taxes, health insurance, or retirement contributions.

Here’s a simple breakdown:

| Component | Included in Gross Payroll |

|---|---|

| Basic Salary | Yes |

| Overtime Pay | Yes |

| Bonuses | Yes |

| Taxes | No |

| Health Insurance | No |

Importance In Financial Management

Accurate recording of gross payroll is crucial for effective financial management. It helps in budgeting, forecasting, and financial planning. Knowing the total payroll costs allows businesses to allocate resources efficiently.

Consider these benefits:

- Helps in tracking expenses.

- Ensures compliance with labor laws.

- Aids in financial planning and analysis.

Businesses must record gross payroll accurately to maintain financial health. It impacts both the company’s budget and its ability to meet regulatory requirements.

Credit: www.greatland.com

Dive deeper into Payroll by checking out this article. How Do I Contact Quickbooks Payroll Support by Phone?

Components Of Gross Payroll

Understanding the components of gross payroll is crucial for accurate financial records. Gross payroll includes various elements that make up an employee’s total earnings. These components are essential to determine the correct amount to pay employees before deductions.

Let’s delve into the primary components of gross payroll.

Basic Salary

The basic salary is the fixed part of an employee’s earnings. It does not include bonuses or overtime. This component is agreed upon during the hiring process. It forms the foundation of an employee’s total compensation.

Bonuses And Incentives

Bonuses and incentives reward employees for their performance. They are additional payments beyond the basic salary. These can be annual bonuses, sales commissions, or performance-based incentives. They motivate employees to achieve their goals.

Overtime Payments

Overtime payments compensate employees for extra hours worked. They are calculated based on the number of extra hours. Employers must pay a higher rate for overtime work. This rate is usually higher than the regular hourly wage.

Gathering Payroll Information

Gathering payroll information is a crucial step in recording gross payroll. This process involves collecting accurate employee data, work hours, and attendance records. Ensuring that all details are correct helps calculate precise payroll.

Employee Details

Start by gathering personal and job-related information. This includes names, addresses, and social security numbers. Also, note their job titles, departments, and pay rates. Accurate employee details are essential for precise payroll processing.

Discover more interesting content on Payroll by reading this post. How Long Does It Take to Process Payroll?

Work Hours And Attendance Records

Next, collect data on the work hours and attendance of each employee. This includes regular hours worked, overtime, and any paid time off.

Accurate attendance records help calculate the correct gross pay. Using reliable time-tracking tools can simplify this task.

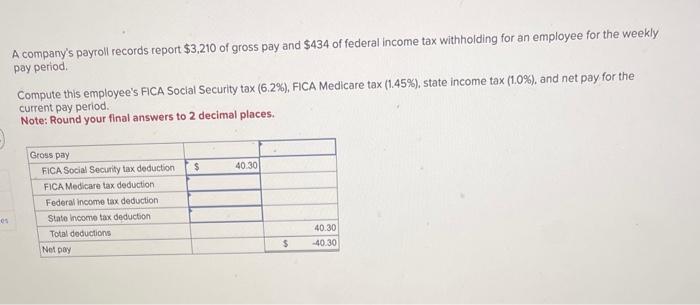

Credit: www.chegg.com

Calculating Gross Payroll

Calculating Gross Payroll is crucial for businesses. It ensures employees receive accurate earnings. This process involves adding all earnings and deducting pre-tax contributions. Let’s explore each step in detail.

Adding Earnings

Start by identifying all sources of earnings. Include basic salary, overtime, and bonuses. Add commissions and tips if applicable. Also, include any additional allowances. Sum up all these amounts. This total represents the employee’s gross earnings.

Deducting Pre-tax Contributions

Next, identify pre-tax contributions. These include retirement plan contributions. Health insurance premiums also fall under this category. Deduct these amounts from the gross earnings. This results in the net taxable income. Pre-tax deductions reduce the taxable income. Thus, they lower the employee’s tax liability.

Recording Gross Payroll In Accounting Software

Recording gross payroll in accounting software is a crucial task for businesses. It ensures accurate financial tracking and compliance with tax regulations. This process involves choosing the right software, entering payroll data, and ensuring accuracy.

Choosing The Right Software

Not all accounting software is the same. Some cater specifically to payroll needs. Look for features like automated calculations, tax filing support, and easy integration with other systems. Consider your business size and complexity. Small businesses may need less complex software. Larger enterprises may need more robust solutions.

Interested in more about Payroll? Here's an article you might find helpful. How to Automate Payroll?

Entering Payroll Data

Once you have chosen the software, the next step is entering payroll data. Start with employee details. Include names, social security numbers, and pay rates. Then, enter work hours for the pay period. Ensure accuracy to avoid payroll errors. Double-check all figures before finalizing entries.

Most software allows batch processing. This feature saves time and reduces manual entry errors. Regularly update payroll data to reflect changes in employee status or pay rates. Consistent updates ensure accurate payroll records and compliance.

Reviewing And Verifying Payroll Entries

Reviewing and verifying payroll entries is a crucial step in payroll management. Accurate payroll records ensure employees receive the correct compensation. It also helps avoid legal issues and financial discrepancies. In this section, we will discuss how to review and verify payroll entries effectively.

Cross-checking With Records

First, compare payroll entries with your company’s records. This includes employee timesheets, attendance records, and contract details. Ensure that all recorded hours match the timesheets. Check that overtime and leave are recorded correctly. Verify that the rates applied are in line with employee contracts.

Cross-checking with records helps identify any discrepancies early. It also ensures that the payroll system is up-to-date. Regular cross-checks can prevent errors from accumulating over time.

Ensuring Accuracy

Accuracy is key in payroll management. Double-check all calculations for each payroll entry. This includes gross pay, deductions, and net pay. Use payroll software to help automate calculations. Even with software, manual checks are still important.

Look for common errors like incorrect tax rates or missing deductions. Ensure that all employee information is current. This includes addresses, bank details, and tax information. Keeping accurate records helps maintain trust and compliance.

Dive deeper into Payroll by checking out this article. What Happens If a Company Can’T Make Payroll? Consequences Unveiled

Common Mistakes And How To Avoid Them

Gross payroll is a critical part of managing a business. It ensures employees are paid accurately and on time. But mistakes can happen, leading to errors and potential penalties. Knowing common mistakes and how to avoid them is crucial.

Incorrect Data Entry

Incorrect data entry is a frequent issue. It can lead to payroll errors and dissatisfied employees. Always double-check the information. Verify employee details like hours worked and pay rates. Use automated systems to reduce human errors.

Misclassifying Employees

Misclassifying employees is another common mistake. Classifying an employee incorrectly can lead to tax issues. Know the difference between full-time, part-time, and contractors. Each has different tax and benefit implications. Ensure your records are accurate.

Maintaining Payroll Records

Maintaining payroll records is crucial for any business. Accurate records help in budgeting, tax filing, and compliance. It also ensures employees are paid correctly and on time. Let’s explore how to maintain payroll records effectively.

Storing Records Securely

Storing payroll records securely is essential. These records contain sensitive information. Use password-protected systems and encrypted storage solutions.

- Use secure software for digital records.

- Store physical documents in locked cabinets.

- Limit access to authorized personnel.

Regularly update your security protocols. This helps protect against breaches and unauthorized access.

Compliance With Legal Requirements

Compliance with legal requirements is non-negotiable. Different countries have different rules. Ensure you understand the regulations in your region.

| Requirement | Description |

|---|---|

| Record Retention | Keep records for a minimum number of years. |

| Employee Privacy | Ensure data protection laws are followed. |

| Tax Documentation | Maintain records for tax filing and audits. |

Consult with a legal expert if unsure about compliance. This ensures you meet all legal requirements.

Finalizing And Distributing Payroll

The final step in the payroll process is finalizing and distributing payroll. This is where you ensure every employee gets their accurate pay on time. This step involves generating pay slips and deciding between direct deposits or checks.

Generating Pay Slips

Pay slips are crucial for both employers and employees. They provide a detailed record of earnings and deductions. To generate pay slips:

- Collect all the necessary payroll data.

- Use payroll software to create the pay slips.

- Review the pay slips for accuracy.

- Distribute the pay slips to employees.

Ensure each pay slip includes:

- Employee details: Name, ID, and job title.

- Pay period: The dates the pay covers.

- Gross pay: Total earnings before deductions.

- Deductions: Taxes, benefits, and other withholdings.

- Net pay: The amount the employee takes home.

Direct Deposits Vs. Checks

Choosing between direct deposits and checks depends on your company’s needs and employee preferences.

| Direct Deposits | Checks |

|---|---|

| Funds are transferred directly into employee bank accounts. | Physical checks are handed to employees. |

| More secure and reduces the risk of lost checks. | Can be lost or stolen, leading to delays. |

| Faster processing and funds are available immediately. | Takes longer to process and cash. |

| Environmentally friendly and reduces paper waste. | Requires paper and can contribute to waste. |

Many companies prefer direct deposits for their speed and security. But some employees might still want physical checks. It’s important to offer both options if possible.

Credit: sage100reports.com

Frequently Asked Questions

What Is Gross Payroll?

Gross payroll is the total amount paid to employees before deductions. It includes wages, salaries, bonuses, and overtime pay.

How Do You Record Gross Payroll?

To record gross payroll, debit the payroll expense account and credit the cash or payroll payable account.

Why Is Gross Payroll Important?

Gross payroll is essential for budgeting, financial planning, and compliance with tax regulations. It affects company expenses and employee compensation.

What Components Are Included In Gross Payroll?

Gross payroll includes basic wages, salaries, overtime, bonuses, and any additional compensation before deductions.

Conclusion

Recording gross payroll is essential for business success. It ensures accurate financial records. Follow the steps mentioned to keep your payroll organized.

This helps avoid errors and ensures compliance with tax laws. Simple and consistent records make audits easier. By doing this, you support your business’s financial health.

Stay organized and diligent with payroll records. Your business will benefit in the long run. Keep your financial records clear and concise.