Author: Poli Kolymnia

-

How to Fix Payroll With AI: Streamline Efficiency & Accuracy

Fixing payroll with AI is simpler than you think. AI can streamline payroll processes, saving time and reducing errors. In today’s fast-paced business world, payroll management is crucial. Mistakes can lead to unhappy employees and costly penalties. Traditional payroll methods often involve tedious tasks and human errors. But AI offers a solution. By automating calculations…

-

Hr Vs Payroll: Streamline Your Business Operations

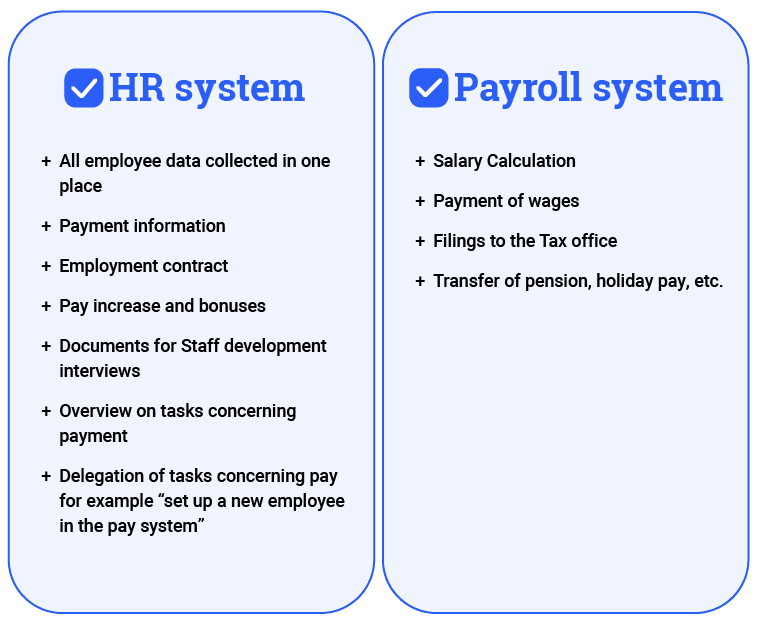

HR and Payroll are essential parts of any business. Both have unique roles. Understanding the differences between HR and Payroll can help you manage a business better. HR focuses on employee relations, training, and recruitment. Payroll deals with salaries, wages, and taxes. These functions might seem similar but serve different purposes. Knowing each department’s role…

-

Payroll Vs Human Resources: Understanding the Key Differences

Payroll and Human Resources are essential functions in any organization. Both roles are crucial, but they serve different purposes. Understanding the differences between Payroll and Human Resources can help businesses run smoothly. Payroll focuses on employee compensation, ensuring that everyone gets paid correctly and on time. Human Resources, on the other hand, deals with employee…

-

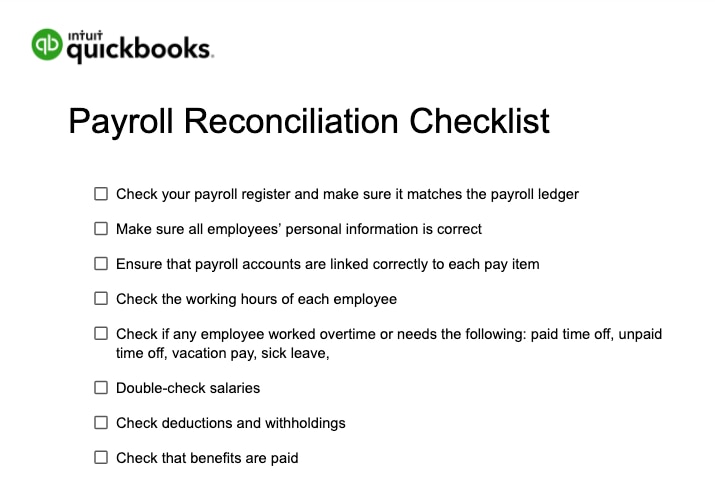

How to Reconcile Payroll: A Step-by-Step Guide

Reconciling payroll is crucial for any business. It ensures employees are paid correctly. Payroll reconciliation might sound complex, but it’s manageable. This process involves comparing payroll records with financial statements to catch errors. It’s essential for accurate bookkeeping and compliance with tax regulations. By reconciling payroll, you can avoid discrepancies that might lead to costly…

-

What is Shrne Services on My Payroll: Essential Guide

Shrne Services is a feature found on many payroll platforms. It helps manage employee payroll efficiently. Understanding Shrne Services can greatly simplify payroll tasks. It offers tools to streamline calculations, manage deductions, and ensure compliance with tax laws. Many businesses rely on Shrne Services to reduce errors and save time. Whether you are a small…

-

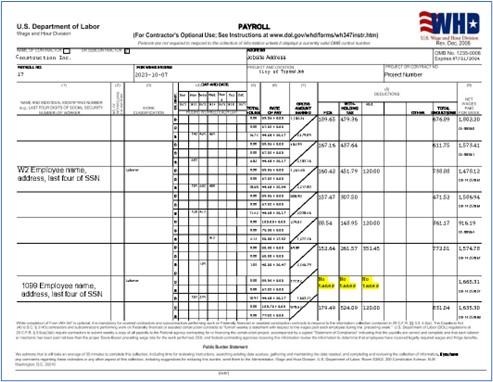

How to Do Certified Payroll for 1099 Employees: A Step-by-Step Guide

Certified payroll can be tricky for 1099 employees. It’s different from regular payroll. You need to follow specific rules and regulations. Understanding certified payroll for 1099 employees is crucial. Contractors must ensure compliance to avoid penalties. The process involves accurate record-keeping and reporting. This blog will guide you through the essentials. You will learn the…

-

What is Union Payroll: Essential Guide for Employers

Union payroll refers to the system of paying union workers. It ensures workers get fair wages and benefits. Union payroll is crucial for businesses employing unionized workers. This system handles the specific needs and agreements of union employees. It involves processing wages, benefits, and ensuring compliance with union regulations. Companies must adhere to these standards…

-

What Is the Most Significant Payroll Challenge for Small Businesses?

Small business’s most significant payroll challenge is compliance with ever-changing tax regulations and labour laws. Failing to stay updated can lead to costly penalties and legal issues, making accurate payroll management critical for success. Running a small business is rewarding, but managing payroll can feel like navigating a maze blindfolded. I remember my own experience…

-

How To Find Payroll Provider?

Finding the right payroll provider doesn’t have to be complicated. Start by assessing your business needs, comparing options, and verifying providers’ reputations. The best payroll provider will save you time, streamline processes, and ensure compliance. “How do I find my payroll provider?” This was a question I asked myself when my small business started to…

-

Is Hostinger vs Wix the Right Choice for Your Website?

Choosing between Hostinger and Wix depends on your needs. Hostinger excels in affordable web hosting, while Wix is a great website builder for beginners. Learn which is best for you. When I first started building websites, the choice between Hostinger and Wix felt overwhelming. Both platforms cater to different needs, but how do you know…