Author: MD SAZZAD HOSSAIN

-

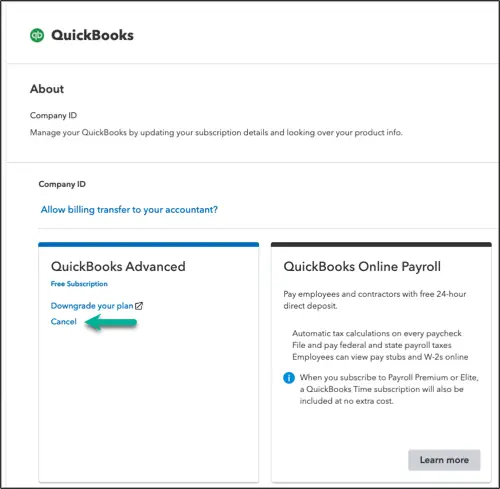

How Do I Cancel Quickbooks Payroll: Step-by-Step Guide

Canceling QuickBooks Payroll is straightforward. It can be done in a few simple steps. Here’s how to do it. QuickBooks Payroll is a popular tool for many businesses. It helps manage employee payments easily. But sometimes, you might need to cancel this service. Maybe your business needs have changed, or you found a better option.…

-

How to Integrate Timesheets With Adp Run Payroll: Seamless Guide

Integrating timesheets with ADP Run Payroll can streamline your payroll process. This guide will show you how to achieve this seamlessly. Managing payroll can be complex, especially when you handle timesheets separately. Integrating timesheets with ADP Run Payroll simplifies this task. It ensures accurate and timely payments to employees. This integration reduces manual data entry,…

-

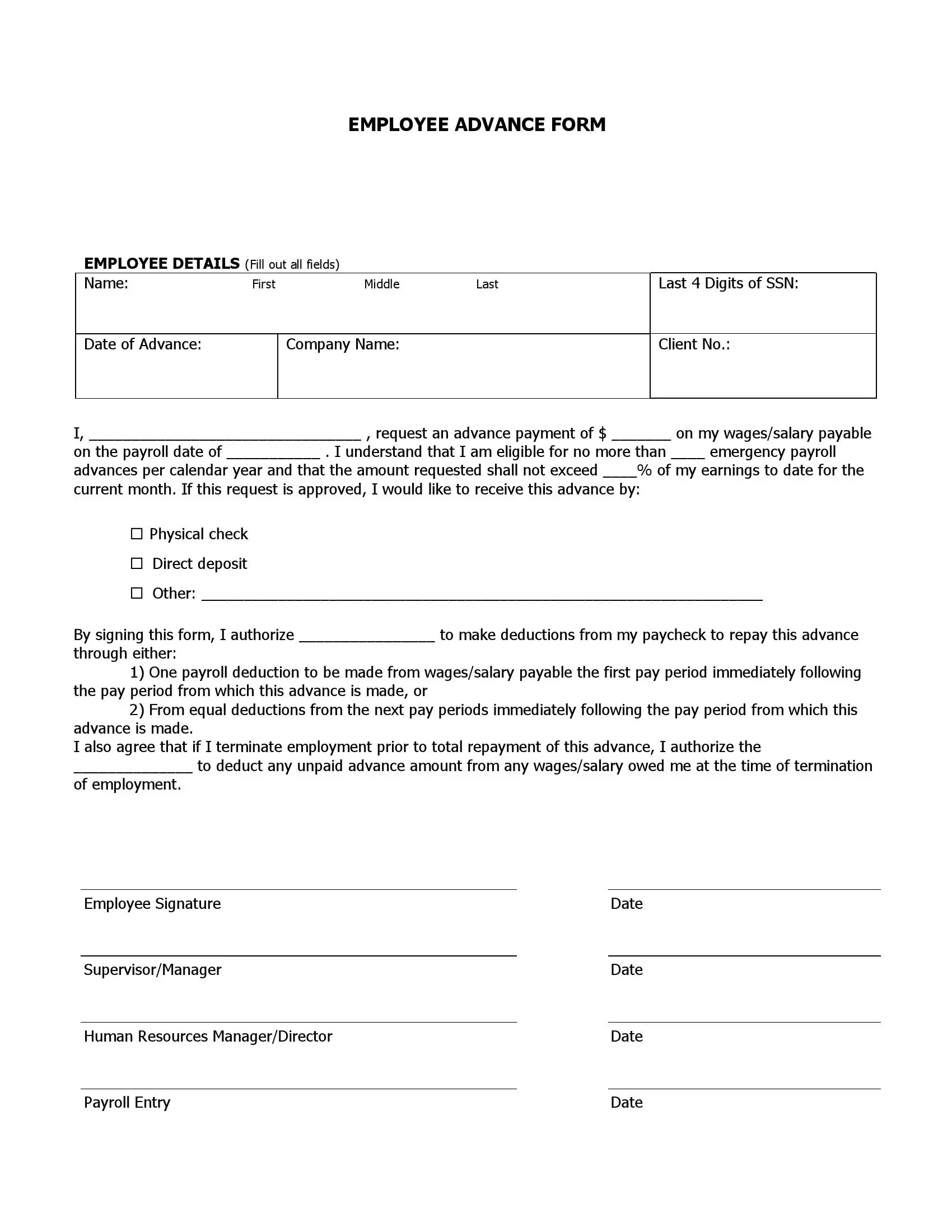

Payroll Advance Agreement Template: Simplify Employee Loans

Understanding payroll advances can be crucial for both employees and employers. A payroll advance agreement template simplifies this process. A payroll advance allows employees to access a portion of their earned wages before payday. This can be a lifesaver in emergencies. Employers benefit by providing a valuable service, potentially increasing employee satisfaction and retention. But,…

-

Gross Payroll How to Record It?

Gross payroll refers to the total amount paid to employees before any deductions. Recording gross payroll accurately is crucial for businesses. It ensures compliance with tax laws and proper financial reporting. Managing payroll can be challenging, especially for small businesses. Understanding how to record gross payroll correctly is essential. It involves tracking employee earnings, taxes,…

-

5 Basic Steps in Processing Payroll: Simplified Guide for Success

Processing payroll is crucial for any business. It ensures employees are paid correctly and on time. But, it can be a daunting task, especially for small business owners. Understanding the steps involved can simplify the process and reduce stress. Payroll processing involves several steps. Each step must be done accurately to avoid errors and penalties.…

-

Does Tops Cash Payroll Checks on Sunday?

Yes, Tops cashes payroll checks on Sundays. You can visit their store for this service. Tops Friendly Markets is a popular grocery chain. Many people rely on them for various services, including cashing payroll checks. Life gets busy, and you might need to cash your check on a Sunday. Knowing if Tops offers this weekend…

-

How to Reduce Payroll Taxes: Top Strategies for 2025

Reducing payroll taxes can significantly boost a business’s financial health. Small changes can lead to big savings. Payroll taxes can be a major expense for businesses. Managing these costs effectively can help improve overall profitability. Many business owners are unaware of the strategies available to reduce payroll taxes. This lack of knowledge can lead to…

-

How Much for Payroll Services: Affordable Solutions for Businesses

Payroll services can vary greatly in cost. Understanding what influences these prices is crucial. Are you a business owner considering payroll services? You’re probably wondering about the costs involved. Payroll services can save time and reduce errors, but how much should you expect to pay? The price can depend on several factors, including the size…

-

How to Categorize Payroll Service Fees: A Complete Guide

Categorizing payroll service fees can be tricky. But knowing how to do it is crucial for managing your business finances. Payroll service fees can include a range of costs such as processing, tax filing, and reporting fees. Understanding how to categorize these fees helps in tracking expenses and ensuring compliance. It simplifies your accounting process,…

-

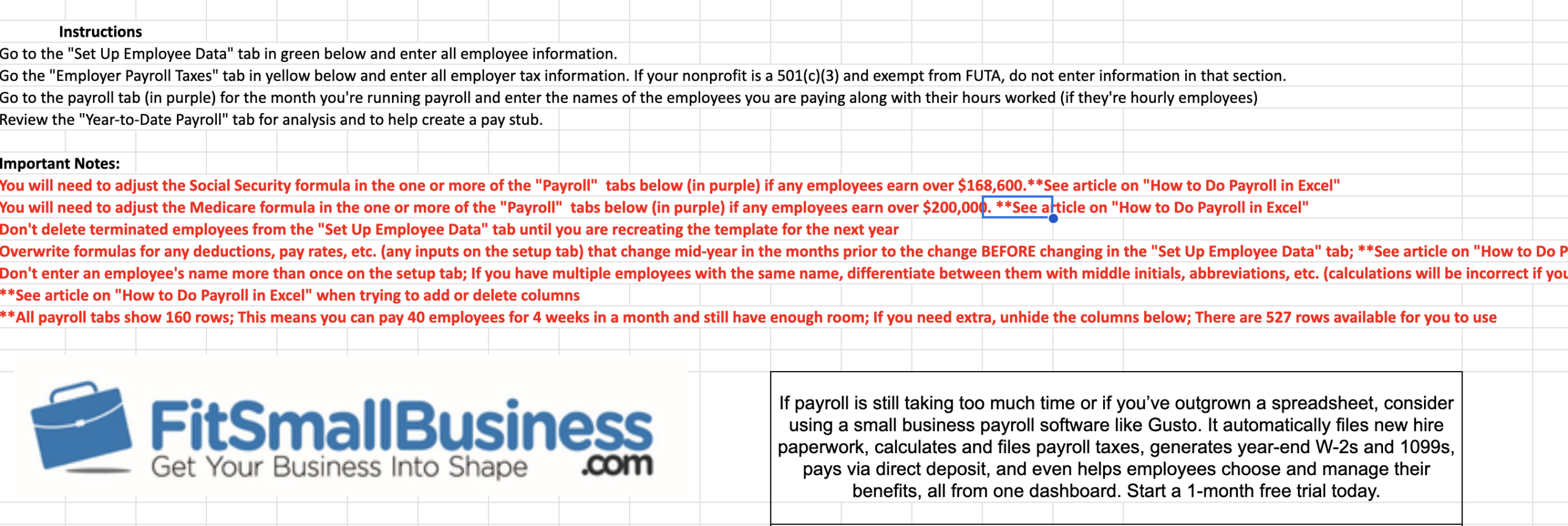

How to Set Up Payroll for Nonprofit: A Step-by-Step Guide

Setting up payroll for a nonprofit can seem daunting. But it’s crucial for smooth operations and compliance. Nonprofits have unique payroll needs compared to for-profit businesses. Understanding these differences helps ensure accuracy and legality. In this guide, we’ll explore how to set up payroll for your nonprofit organization. You’ll learn about essential steps, from determining…