Day: January 12, 2025

-

5 Basic Steps in Processing Payroll: Simplified Guide for Success

Processing payroll is crucial for any business. It ensures employees are paid correctly and on time. But, it can be a daunting task, especially for small business owners. Understanding the steps involved can simplify the process and reduce stress. Payroll processing involves several steps. Each step must be done accurately to avoid errors and penalties.…

-

Does Tops Cash Payroll Checks on Sunday?

Yes, Tops cashes payroll checks on Sundays. You can visit their store for this service. Tops Friendly Markets is a popular grocery chain. Many people rely on them for various services, including cashing payroll checks. Life gets busy, and you might need to cash your check on a Sunday. Knowing if Tops offers this weekend…

-

How to Reduce Payroll Taxes: Top Strategies for 2025

Reducing payroll taxes can significantly boost a business’s financial health. Small changes can lead to big savings. Payroll taxes can be a major expense for businesses. Managing these costs effectively can help improve overall profitability. Many business owners are unaware of the strategies available to reduce payroll taxes. This lack of knowledge can lead to…

-

How Much for Payroll Services: Affordable Solutions for Businesses

Payroll services can vary greatly in cost. Understanding what influences these prices is crucial. Are you a business owner considering payroll services? You’re probably wondering about the costs involved. Payroll services can save time and reduce errors, but how much should you expect to pay? The price can depend on several factors, including the size…

-

How to Categorize Payroll Service Fees: A Complete Guide

Categorizing payroll service fees can be tricky. But knowing how to do it is crucial for managing your business finances. Payroll service fees can include a range of costs such as processing, tax filing, and reporting fees. Understanding how to categorize these fees helps in tracking expenses and ensuring compliance. It simplifies your accounting process,…

-

How to Set Up Payroll for Nonprofit: A Step-by-Step Guide

Setting up payroll for a nonprofit can seem daunting. But it’s crucial for smooth operations and compliance. Nonprofits have unique payroll needs compared to for-profit businesses. Understanding these differences helps ensure accuracy and legality. In this guide, we’ll explore how to set up payroll for your nonprofit organization. You’ll learn about essential steps, from determining…

-

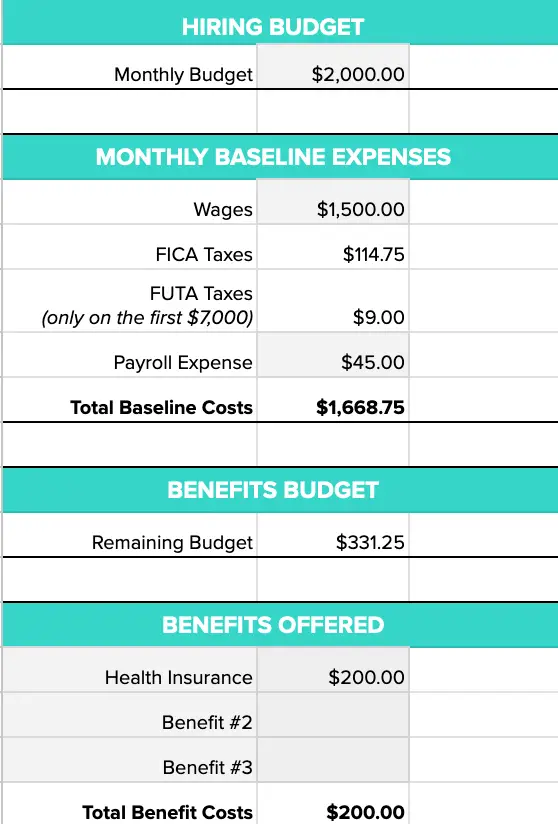

How to Calculate Payroll Budget: A Step-by-Step Guide

Calculating a payroll budget can seem daunting. Yet, it is essential for business success. A well-managed payroll budget helps control costs and ensures employees are paid accurately. This guide will simplify the process for you. We’ll break down each step, making it easy to follow. Proper payroll budgeting keeps your business financially healthy. It also…

-

How to Analyze Payroll Data: A Step-by-Step Guide

Analyzing payroll data is crucial for any business. It helps in understanding expenses and planning budgets. Payroll data analysis uncovers patterns in employee compensation and benefits. It reveals trends and ensures compliance with labor laws. This process can save businesses money and improve efficiency. By examining payroll data closely, companies can identify errors, reduce costs,…